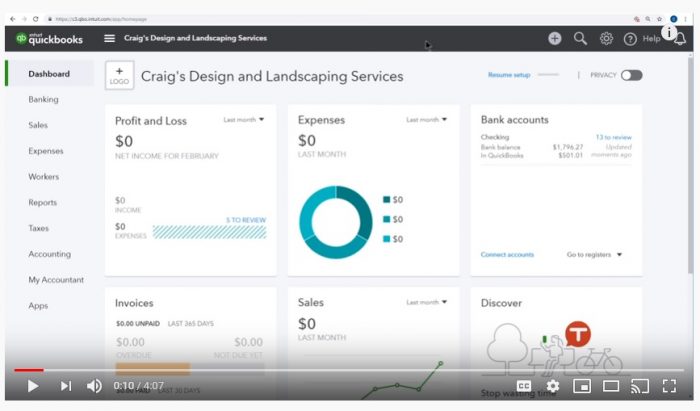

QuickBooks®Online Tip: How to Categorize Bank and Credit Card Transactions

Once you have downloaded your bank and credit card transactions into QuickBooks® Online QBO, view them by clicking “Banking” on the left column of your dashboard. It’s important to recognize that it’s not until the transactions have been put into their respective income or expense category (as dictated by the chart of accounts) that the…